F R E E W E B I N A R | THURSDAY, AUGUST 29TH AT 7P M E S T

Are High Taxes Draining

Your Business Profits?

Slash your tax bill & Don't let high taxes cripple your businesses growth! Join our free webinar to unlock expert tax strategies that can save you thousands and boost your bottom line.

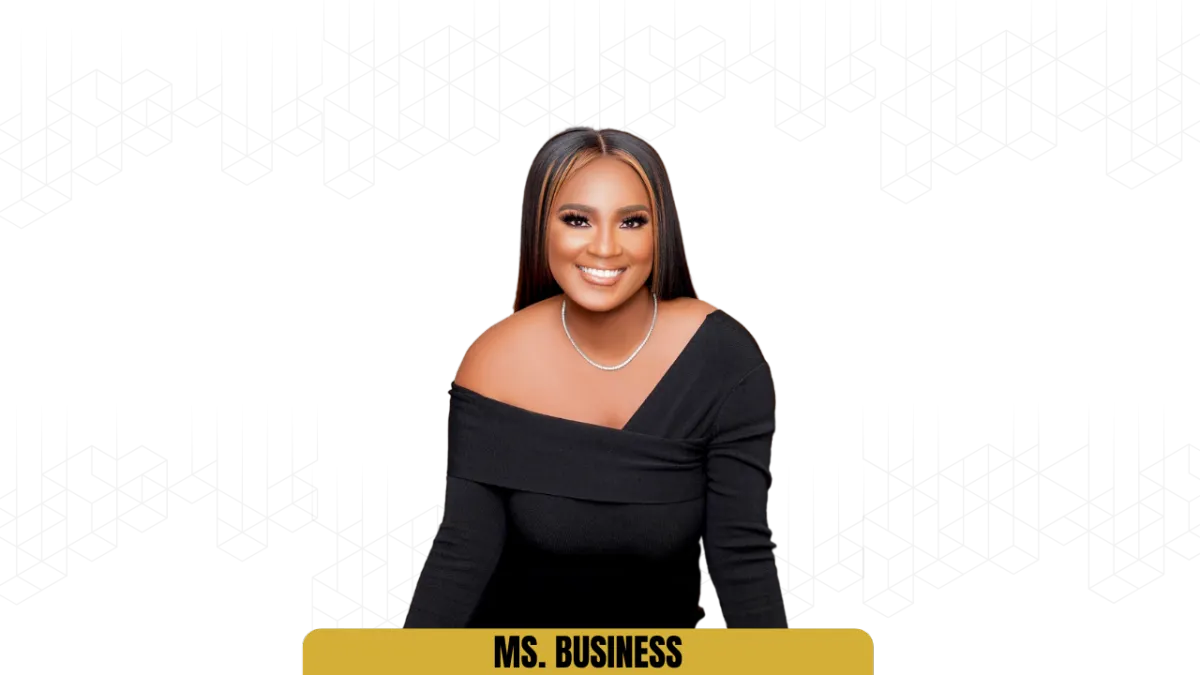

HOSTED BY MS. BUSINESS, CERTIFIED PUBLIC ACCOUNTANT

WHAT YOU'LL LEARN IN

THIS FREE LIVE TRAINING:

Advanced Tax Deduction Techniques

Dive deep into advanced methods for identifying and claiming deductions specific to your industry. We'll cover:

How to leverage depreciation for equipment and property.

Utilizing Section 179 for immediate expense deductions.

Identifying and documenting lesser-known deductions, such as home office expenses, travel, and professional development.

Identifying and Leveraging Tax-Free

Strategic Tax Planning for Business Growth

Develop a comprehensive tax strategy that aligns with your business goals. This includes:

Learn how to shift when you earn money or spend it to lower your tax bill. For example, delay receiving income until the next year or make purchases now to reduce your taxable income for this year.

Find out how to take advantage of special accounts like retirement plans and health savings accounts that offer tax benefits that can help you save money and reduce your taxes.

Audit-Proofing Your Business

Learn how to prepare and maintain thorough documentation to safeguard your business during an IRS audit. Key points include:

Best practices for record-keeping and digital storage.

Understanding red flags that trigger audits and how to avoid them.

Steps to take if you're audited, including how to respond to IRS inquiries and what to expect during the process.

JOIN "THE QUEEN OF THE TAX CODE" FOR AN EXCLUSIVE LIVE EVENT THAT'LL HELP YOU REDUCE YOUR TAX BURDEN

Ms. Business

Impact & Reach...

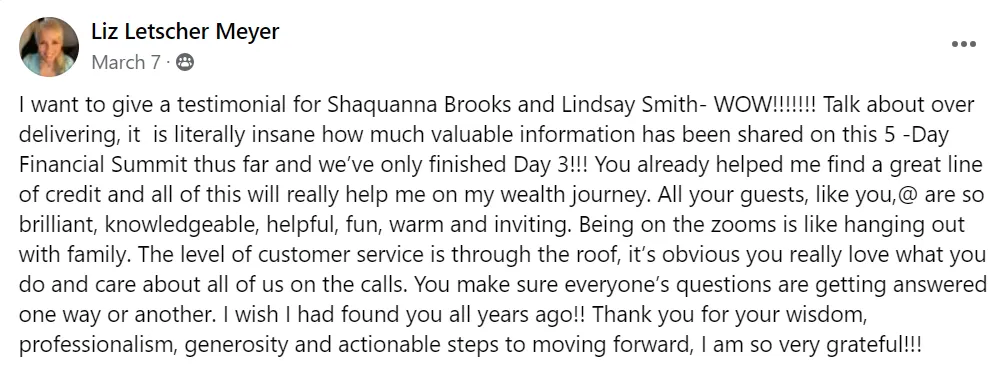

Ms. Business – has become catalysts for change, enabling individuals to construct lasting wealth through strategic wealth building that creates legacies that live for generations.

TITLE

My experience with Lindsay was informative, professional and seamless. l was able to get all my questions answered in one call and clearly understood next steps. She talked me through realistic options that worked with my current budget. l was able to start securing my family’s financial future and l am thankful for Lindsay’s education and help through the process.

title

TITLE

Lindsay and her team are unmatched. Lindsay walked me through specific plans that catered to my direct needs and nothing was “cookie cutter.” She also didn’t make me feel like I was behind in taking care of business but rather met me where I was to help me get to where I want to go. Her team professionally and effectively communicated final steps with me to ensure smooth closing and delivery of my policies. I’d recommend Lindsay a million times over!

title

TITLE

Lindsay and her Assistant Rey were amazing educating myself and wife on life insurance and helped us secure policies for both myself and wife. We thank you both

title

MEET YOUR INSTRUCTOR

Your Host...

Shaquanna BROOKS

'Ms. Business'

Shaquanna “Ms. Business” Brooks; entrepreneur and Certified Public Accountant with 10+ years of accounting, finance, business formation, and consulting experience. She is the founder and owner of Brooks Alliance, a diverse tax, financial services, business formation, and accounting company. She founded the company in 2017.

Brooks Alliance has built a client base of 3000+ individuals, Small Business Owners & Freelancers with a combined client revenue of over $105 million dollars.

AS SEEN ON

THE GOAL IS...

Identify Hidden Deductions

Learn to uncover often-overlooked deductions and credits that can significantly reduce your tax liability.

Implement Tax-Saving Strategies

Gain actionable insights on strategic tax planning techniques to optimize your financial position.

Maximize Business Expenses

Understand how to effectively categorize and maximize your business expenses to lower your taxable income.

Plan for Long-Term Savings

Discover long-term tax planning strategies that ensure sustained financial growth and security for your business.